How public markets can unlock emerging and frontier economy opportunities

The annual Sustainable Development Goal (SDG) financing gap in developing countries amounted to more than $3.7 trillion in 2020.[1] At $178.9 billion per annum, total flows of official aid are insufficient.[2] With more than $100 trillion in equity capitalisation on global stock exchanges in 2021,[3] private sector investors, through transparent public markets, can play a critical role in financing the SDGs.

At the end of September 2022, MOBILIST brought together a global panel of experts to reflect on pioneering public market product structures and strategies needed to channel more capital into productive investment in emerging markets and developing economies (EMDE). The event drew from panellist insights, forthcoming MOBILIST research, and findings from the MOBILIST product portfolio and pipeline.

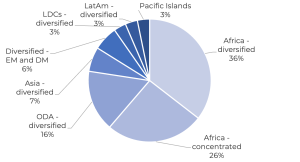

For example, MOBILIST’s 2021 Sustainable Infrastructure Competition unearthed a growing, diverse, and commercially viable pipeline offering exposure to EMDEs and their sustainable development. 44 scalable product proposals were put forward for MOBILIST investment through the Competition. Critically, an equal-weight portfolio across these products would align capital much more closely with need for development finance, than for example a portfolio tracking the MSCI EFM Index (which offers a 3.8% Africa weighting) or even the MSCI FM Index (offering a 24.4% Africa weighting).

Figure 1 – Product Competition submissions split by geographic focus of investment

Submissions to the Competition generated a number of critical insights, and established that a substantial investment pipeline did indeed exist, presenting a spectrum of scalable solutions:

- It was clear that different products could successfully address similar problems, with comparable underlying assets accessible through diverse structures. For example, while listed funds and securitisations were more common for operational assets, private funds and credit protection structures worked well for incubating earlier-stage assets.

- The listed investment trust was the most popular structure to be proposed to the MOBILIST Competition. Having been purpose-built in the 19th Century to finance infrastructure and real economy strategies needed to drive economic development in North America and other emerging regions, the investment trust structure creates crucial liquidity for otherwise illiquid assets and protects managers from selling into down-turns.

- Exit mobilisation allows capital to be recycled through listed products, whether by Development Finance Institutions (DFIs) or private investors in development assets. DFIs can learn from their private sector peers, whose business models are built on more varied portfolio strategies than the typical ‘buy-and-hold’ approach more common in the official development finance sector.

- While familiar structures will offer the swiftest route to market for new products, more complex structures proposed to the MOBILIST Competition, while likely to require market education and support, could be transformational in the long run. A balanced portfolio approach to developing the market is required, mobilising capital through familiar products in the near-term while cultivating a cohort of more innovative structures and strategies to scale over time.

- To shift from millions to billions allocated to EMDEs and their sustainable development, we need scalable, replicable product structures and investment strategies, for example through dual-listing and secondary raise. We also need vehicles and products to address larger institutional investors’ liquidity and risk requirements post-listing. In short, IPO should be seen as a milestone en route to scale, not an end point in itself.

These findings were amplified and elaborated by contributions from the panel of capital market experts, including asset allocators, DFIs, and fund managers. We heard how a wide range of capital markets skills and judgement was required in determining the choice of financial structure best suited to the underlying investment strategy, sector, and geography. A few examples from a rich selection of insights:

- We heard how the maturing risk profile of an asset enabled its transfer to investors with lower risk appetite through listed markets. This in turn invited the use of a structure – such as the investment trust – that might appeal to a broader range of potential investors than the narrow group able to invest directly into long-dated illiquid private assets.

- In relation to the need for rotation of private equity capital into public market structures, a number of issues were raised. In the first instance, markets must be selected to match the regional expertise of investors to the location of investible assets. The scale of the offer must also be considered, with larger investors facing constraints in relation to smaller and less liquid opportunities.

- Understanding allocators’ objectives as well as their constraints was vital to successful capital raises. For example, we know that there has been a huge shift towards recognising the importance of SDGs in investing, but no amount of impact could compensate if institutional investors’ fiduciary safeguards and return expectations could not be met.

As 2030 looms ever larger on the horizon, the need for scalable financing solutions to deliver the SDGs and international climate commitments is becoming increasingly urgent. MOBILIST will continue to build track record from which other investors can learn, by sourcing, investing in, and supporting new commercially viable investment products looking to list. Our research will continue to share learnings from this investment strategy and broader efforts to shape the public markets policy and regulatory environment, as we attempt to harness these deep pools of capital for EMDEs’ sustainable development.

Read more about the event, find out about our panellists and watch the recording in full here.

[1] The World Federation of Exchanges, Market Highlights

[2] OECD and UNDP, Closing the SDG Financing Gap in the COVID-19 era 2022

[3] OECD, ODA Levels in 2021 – Preliminary Data 2022