Bridging intent and impact: Towards a gender-smart framework for the future of credit investing

This report, co-authored by Amundi and Access Alliance, Inc., examines the growth of gender‑focused bonds and the persistent challenges around data and impact measurement in gender-lens investment. It proposes a practical framework to embed gender considerations at the issuer level and help investors align capital with measurable outcomes, and is accompanied by a Guidebook offering practical tools and guidance for applying these concepts in day-to-day investment practice.

It was developed as part of technical assistance delivery under the MOBILIST programme. In this context, Amundi received targeted support to further develop a gender-lens investing framework, with the goal of deepening market standards and fostering innovation in gender-focused fixed-income investments.

Gender Equality is an Economic Imperative

Gender is more than a peripheral ESG issue.

Gender equality is a material driver of economic growth and investment performance. Persistent gender disparities, particularly in emerging markets, continue to constrain inclusive growth, productivity, and economic resilience. As emerging economies navigate a convergence of structural challenges – including demographic ageing, productivity slowdowns, and financial system fragmentation – the economic inclusion and progression of women stands out as a critical yet underleveraged solution.

This report shares insights from Amundi’s work to strengthen gender-lens investing and includes feedback from market participants, a proposed innovative gender-smart investing framework and case studies based on engagement with companies and sovereigns to promote women’s inclusion and workforce participation.

Gender‑Focused Bonds: Essential, but Still Nascent

The gender-focused bond market comprises less than 2% of all Sustainable Bonds.

IFC data suggests significant growth in both the number and volume of gender bonds issued between 2013 and 2024. By 2024, cumulative issuances of bonds with verifiable allocation and/or impact data for women’s empowerment reached approximately US$160 billion.

However, the continued growth and credibility of this market will hinge on the active participation of impact and institutional investors who can align capital with gender frameworks and hold issuers accountable for outcomes. Even in the absence of gender focused Sustainable Bonds, investors can apply gender-smart ESG frameworks to identify sovereigns and corporates with credible commitments to gender equality. These frameworks should assess both policy and performance, favouring transparency and measurable progress.

$160 million

By 2024, cumulative issuances of bonds with verifiable allocation and/or impact data for women’s empowerment reached approximately US$160 billion.

440 bonds

Cumulative gender-bond issuances consist of over 440 bonds issued by 170 entities across 55 emerging markets and developed economies.

36%

Private sector financial institutions and corporates collectively represent over 36% of total issuance volume, compared to 33% by MDBs.

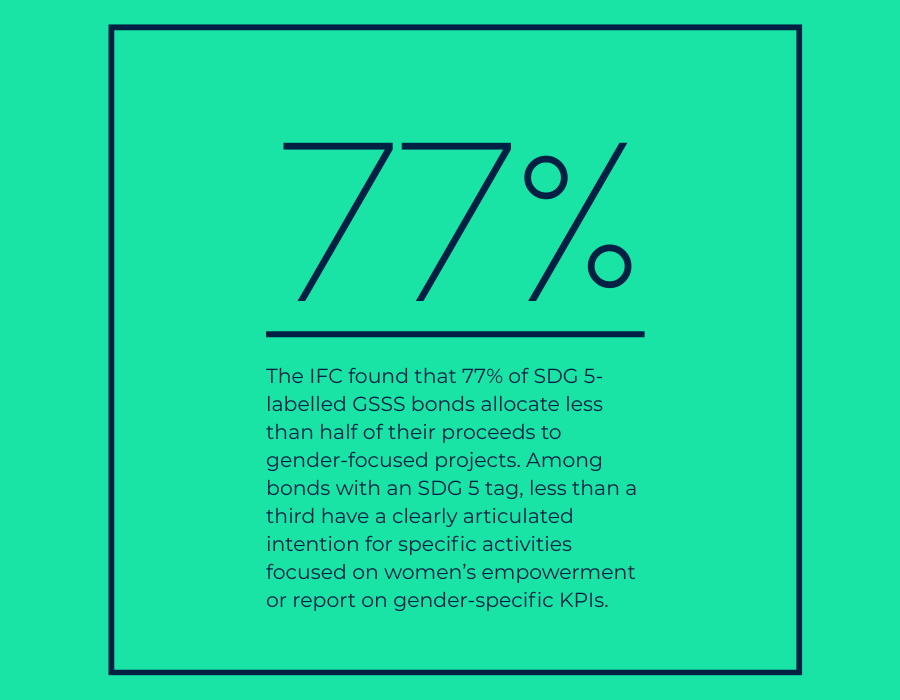

The Intent-Impact Gap: Data and Accountability

Only a small proportion of gender‑focused bonds include gender‑specific, outcome‑level indicators, and many lack sex‑disaggregated data altogether. While more issuers are incorporating gender-themed language into their Sustainable Bond frameworks, the underlying data often fails to meaningfully track or substantiate gender outcomes. The broader market also lacks a robust verification infrastructure.

This undermines transparency and limits investors’ ability to assess real‑world impact. Fragmented systems, underutilised KPIs, and inconsistent guidance impede investor confidence. Without clearer KPIs, stronger disclosure, and improved assurance mechanisms, the risk of “impact‑washing” remains high. Having sex-disaggregated targets and reporting is key, as that constitutes the only way to ensure the gender interventions are visible, measurable, and credible.

The Way Forward

Gender should be embedded across capital structures, issuer strategies, ESG screening, and performance metrics, rather than confined to labelled products alone. This approach can expand the investable universe while maintaining intentionality and accountability. Active stewardship, targeted technical assistance, particularly for emerging market issuers, and greater regulatory convergence can accelerate market maturity.

The future lies in integration, not isolation. This means the next evolution of gender finance must use a transversal lens embedded in capital structures, issuer strategies, and performance metrics instead of siloed products or labels.

Proactive Technical Assistance (TA) is essential

First-time or smaller issuers – especially in emerging markets – need more hands-on support. TA should focus on establishing baselines, selecting context-appropriate KPIs, and structuring gender-focused reporting to help close persistent data gaps.

Regulatory convergence can drive market maturity

Harmonising standards across frameworks (ICMA, 2X, OECD, etc.) – and offering practical guidance for embedding gender – can transform gender from an optional overlay into a core pillar of sustainable finance design.

National taxonomies offer a model for integration

Countries like Mexico and Brazil have incorporated gender into their sustainable finance taxonomies. These models offer replicable frameworks for defining gender-aligned investment at the sovereign level.

Corporate and sovereign issuers both play a role

Companies can embed gender in leadership, operations, and supply chains; governments can align bond proceeds with public gender policies. Both types of issuers can drive market scale and integrity.

Guidebook to Gender-Inclusive Investing

There is emerging consensus among market actors that gender impact should not be confined to “Gender or Orange Bonds”. Instead, it should examine how issuers embed gender into their overall strategy – through leadership, workforce, operations, and policies.

This Guidebook is designed as a reference for how investors and practitioners are beginning to apply this mainstreaming approach. It outlines how issuers can position themselves to access gender-smart capital through both labelled and general-purpose bonds, how investors can identify and support gender-strong issuers, and what ecosystem actors can do to enable market development.

More Resources on Gender-Lens Investing

- 2X Criteria Reference Guide (Last updated 2025)

- UN Women (2025) Sustainable Finance Taxonomies with Gender Equality Considerations.

- Bonds to bridge the gender gap: A practitioner’s guide to using sustainable debt for gender equality

- UN Women & Luxembourg Stock Exchange (2023) Case study series: Innovative financing United States Dollar (USD) for gender equality via bonds.

- IIX Global (2022). Orange Bond Principles.

- Luxembourg Stock Exchange and 2x Global (2025). Empowering Change: The Rise and role of Gender-Focused Bonds.